This is known as the accounting equation, and it is at the heart of double-entry accounting. With double-entry bookkeeping, each debit must always have an equal corresponding credit to keep this equation in balance: Assets = Liabilities + Equity

You must therefore adjust both the cash and mobile phone accounts in your double entry ledger: Account Under double-entry accounting, you would make two entries: you trade one asset (cash) for another asset (mobile phone). You have started a new takeaway business and want to buy a new phone for when you are out on deliveries. Some examples of how double-entry bookkeeping works are set out below: Example 1: Buying with cash Some business owners will deal with the entirety of their double-entry bookkeeping, however in most cases bookkeepers or accountants are involved to help set up and run suitable systems to deal with bookkeeping needs. It is the only way to ensure that financial information is complete and correct and will support all the ongoing reporting functions that business may have. Very simply, all businesses will need to use double-entry bookkeeping. Using double-entry bookkeeping to record transactions provides you and your accountant with a detailed, comprehensive view of your financial affairs. It also enables business owners to track their finances on a regular basis, helping them to understand how the business is performing and supporting key financial decisions. It can then provide the owners or their accountants with the information they need to deal with all the tax and financial submission requirements the business will have such as VAT returns, annual accounts, tax returns and cashflow statements.

What is double-entry bookkeeping used for?ĭouble-entry bookkeeping (which is sometimes referred to as double-entry accounting) allows a business to record all its financial transactions in a structured way.

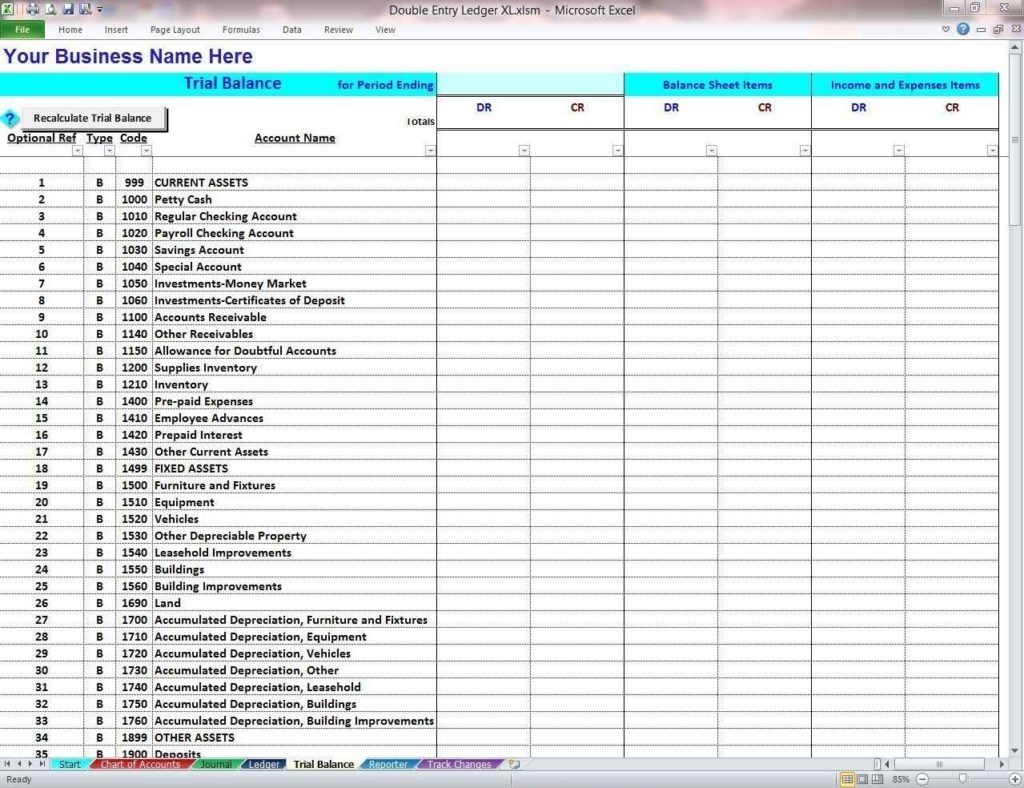

DOUBLE ENTRY BOOKKEEPING VS DOUBLE ENTRY ACCOUNTING TRIAL

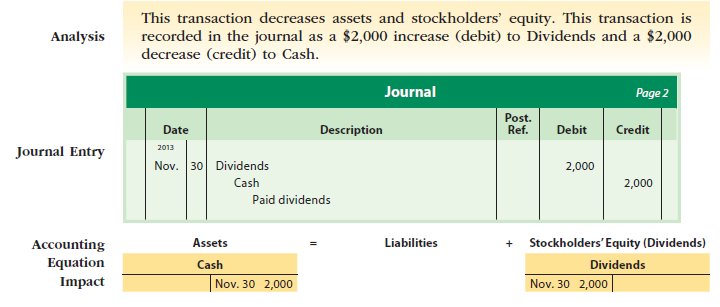

When done correctly, your trial balance will show the overall balance of credits is the same as the overall debit balance. These are summarised in a trial balance, which shows the account balances broken down by type being the sum of all related debits and credits. If you record these journal entries in a general ledger, debit entries are recorded on the left, and credit entries on the right. These entries can then be summarised in what is called a general ledger, which represents the sum of all entries, analysed by type. These represent the two sides of every accounting transaction.Ī business’ accounting records, whether simple or complicated, will be an accumulation of these double entries. The entries resulting from double entry bookkeeping are often referred to as debits and credits. This is why accountants talk about things balancing and make references to a ‘balance sheet’ in accounts.

So for example, if you sell goods your cash balance increases and your stock levels will go down. The principles of double-entry bookkeeping are very simple - every transaction will have two equal and opposite elements. What are the principles of double-entry bookkeeping? It also supports all the ongoing reporting and submission requirements businesses have – VAT returns, annual accounts, tax returns, etc all rely on double-entry bookkeeping. It allows a business to track all its transactions and helps it to understand how it is performing in terms of profitability, cash balances and business growth.

0 kommentar(er)

0 kommentar(er)